I've previously noted that concentration of all the poker chips in a couple of hands ends the poker game.

And I've repeatedly pointed out that when banks get too big, it hurts the economy.

I've also noted that the government actually encouraged the big banks to get bigger and bigger (and see this, this and this). As just one example, the Treasury Department encouraged banks to use the bailout money to buy their competitors, and pushed through an amendment to the tax laws which rewards mergers in the banking industry.

The government has also given the big banks many tens of trillions of dollars.

In that light, Phd economist and leading economic modeller Steve Keen makes an important new contribution to our understanding of the banking sector.

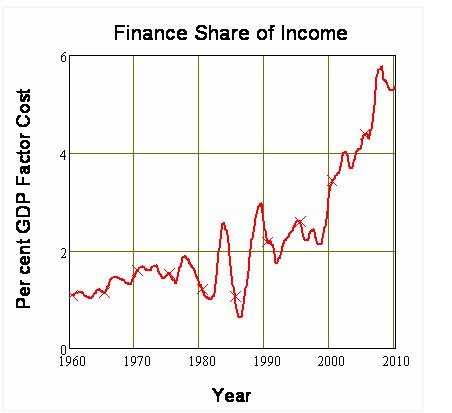

Specifically, Keen's new model shows that bank profits above 1% of GDP are unsustainable, and lead to a Ponzi economy and - eventually - a depression:

Given that giant, super-profitable banks lead to a Ponzi economy and a depression, we must break up the too big to fails, which would allow smaller banks to thrive and to lend out more money to Main Street.The record $6 billion profit that the Commonwealth Bank [Australia's largest bank] is expected to announce today is a sign of an economy that has been taken over by Ponzi finance. Fundamentally, banks make money by creating debt, and the amount of debt we’ve been enticed into taking on is the sign of a sick economy rather than a healthy one. The level of private debt that is actually needed to support business and maintain home ownership at historic levels (ownership levels have fallen over recent years!) is possibly as little as one sixth the current level.

Because of that debt level, bank profits have gone through the roof as a share of GDP. Back before we had a financial crisis—when debt levels were far lower than today—so too were bank profits as a share of GDP. A sustainable level of bank profits appears to be about 1% of GDP.

***

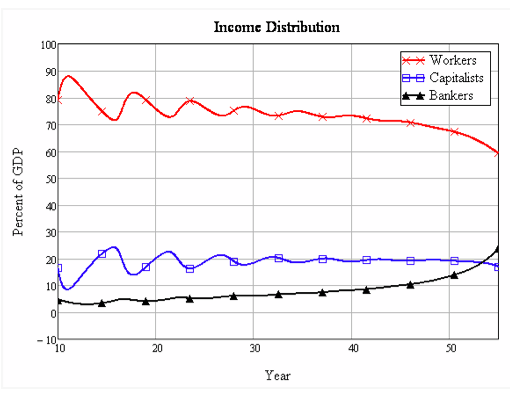

As readers of this blog know, I build models of financial instability, and in my models, one symptom of an economy that is headed for a Depression is a rise in bankers share of income at the expense of workers and capitalists. The model below has yet to be calibrated to the data, but the similarities with the actual data are still ominous.

One empirical reality illustrated by the model as well is that even if firms are the ones taking on the debt (as they are in this model—it does not include household borrowing), workers are the ones that pay for this in terms of a declining share of national income: rising debt is associated with a constant profit share of GDP but a falling workers share.

When the crisis really hits, both workers and capitalists suffer as bank income goes through the roof—leading to a Depression. The only way out of this is to abolish large slabs of the debt, and coincidentally to drive bankers share of income back down to levels that reflect is supportive role as a provider of working capital for firms—rather than a parasitic role as the financier of Ponzi schemes.

This is the real debt story of our economy right now. As the first chart above indicates, private debt is far higher than Government debt, even after the increase last year due to Rudd’s stimulus package. Government debt is currently 5.5% of GDP, whereas private debt—even though it has fallen slightly due to business deleveraging—is over 150% of GDP: 27 times the size of Government debt. The so-called debate that the major parties are having over the size of Government debt is an embarrassment.

Either that, or let's just replace the entire private banking system with state public banking. See this, this and this.