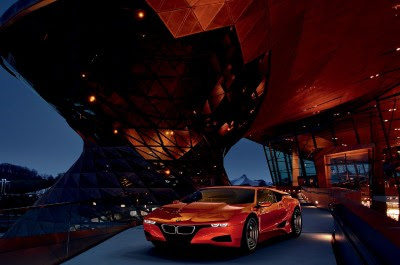

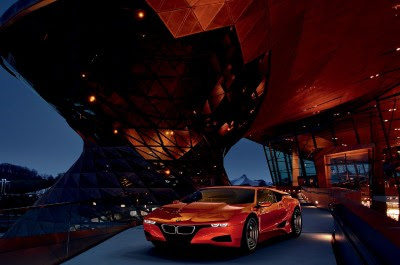

BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car concept BMW sports car concept

BMW sports car conceptScientists from Oregon State University have found a 40-fold increase in the amount of cancer-causing polycyclic aromatic hydrocarbons (PAHs) near Louisiana's Grande Isle between May and June.

The Oregon team is looking at "the fraction of PAHs that are bioavailable – that have the potential to move into the food chain."

As I pointed out last month, PAHs are harmful to both human health and seafood safety:

McClatchy notes today:

The Gulf of Mexico oil spill still poses threats to human health and seafood safety, according to a study published Monday by the peer-reviewed Journal of the American Medical Association.

***In the short term, study co-author Gina Solomon voiced greatest concern for shrimp, oysters, crabs and other invertebrates she says are have difficulty clearing their systems of dangerous polycyclic aromatic hydrocarbons (PAHs) similar to those found in cigarette smoke and soot. Solomon is an MD and public health expert in the department of medicine at the University of California at San Francisco.

The Oregon researchers also believe:

The use of chemical dispersants during the oil spill coupled with the ultraviolet exposure in the Gulf may have increased the formation of OPAHs beyond expected levels.

And one of the researchers explained to the Huffington Post:

Based on the findings of other researchers, [Kim Anderson, an OSU professor of environmental and molecular toxicology] suspects that the abundant use of dispersants by BP increased the bioavailability of the PAHs in this case.

This is not particularly surprising. As I noted earlier this month about another team of scientists studying the effects of dispersant on pollution in the Gulf:

Scientists have found that when Corexit is applied to the actual crude oil from BP's well, it releases 35 times more toxic chemicals into the water column than would be released with crude alone.

As I noted in May, the crude oil released by BP is actually relatively low in PAHs compared to other crudes:

[NOAA says that the Gulf] oil is less toxic than crude oils generally because it is relatively much lower in polyaromatic hydrocarbons (PAHs). PAHs are highly toxic chemicals that tend to persist in the environment for long periods of time, especially if the spilled oil penetrates into the substrate on beaches or shorelines.Given that the BP crude is much lower in PAHs than most crude oil, for there to be 40 times more PAHs than normal is even more dramatic, again showing how effective dispersants have been in releasing the most toxic elements from the oil into the environment ... in fairly high concentrations and pretty much all at once.

sports bikes

sports bikes

Asked about new Census data showing that the income gap between the richest and poorest Americans grew last year to its widest amount on record, Summers said one factor is that "we have a more ruthless economy. There's breaking down in social norms by people in a position to take."

Skyrocketing income disparity is something I've repeatedly written about.

But increasing income disparity hasn't just happened like some unforeseen natural disaster which is difficult to forecast, such as an earthquake. It has been the result of certain efforts by the wealthy and their lackeys in government.

As Warren Buffet said in 2006:

There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.

Indeed, as I pointed out last year, Summers is more responsible for our economic problems than just about anyone else (Greenspan and Rubin also played their parts):

Summers is the guy responsible for:

- Allowing the banks to carry extraordinary levels of debt, thirty-to-one fractional reserve banking margins

- Ensuring that derivatives were not regulated, and that AIG could operate as a giant hedge fund

- Repealing New Deal era legislation which separated investment banks from commercial banks, insurers and stock brokers, and which kept companies from becoming "too big to fail"

As a 1999 New York Times article entitled "Congress Passes Wide-Ranging Bill Easing Bank Laws" quotes Summers as saying:

''Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,'' Treasury Secretary Lawrence H. Summers said. ''This historic legislation will better enable American companies to compete in the new economy.''As I pointed out in April:

As I pointed out in September, Summers has totally misunderstood the multiplier effect.On Friday, Summers basically said we should continue to do the exact same things which got us into this mess because:

All crises must end. The “self-equilibrating” nature of the economy will ultimately prevail, although that may take massive one-off government actions. Such a crisis happens only ”three or four times” per century, so taking on huge amounts of government debt is fine; implicitly, we will grow out of that debt burden.Um . . . sorry to break it to you there Larry, but a group of economics professors has recently demolished the "self-equilibrating economy" theory:If one browses through the academic macroeconomics and finance literature, “systemic crisis” appears like an otherworldly event that is absent from economic models. Most models, by design, offer no immediate handle on how to think about or deal with this recurring phenomenon. In our hour of greatest need, societies around the world are left to grope in the dark without a theory. ...And when economist James Galbraith spoke at a recent panel on the causes of the financial crisis, the first thing he listed as the main cause of the crisis was "The idea that capitalism ... is inherently self-stabilizing" ...The implicit view behind standard models is that markets and economies are inherently stable and that they only temporarily get off track. The majority of economists thus failed to warn policy makers about the threatening system crisis and ignored the work of those who did. ...

The confinement of macroeconomics to models of stable states that are perturbed by limited external shocks and that neglect the intrinsic recurrent boom-and-bust dynamics of our economic system is remarkable. After all, worldwide financial and economic crises are hardly new and they have had a tremendous impact beyond the immediate economic consequences of mass unemployment and hyper inflation. This is even more surprising, given the long academic legacy of earlier economists’ study of crisis phenomena ... This tradition, however, has been neglected ...

Summers [is] like a guy swearing that the Sun really does revolve around the Earth and that the current orbit is just a temporary aberration . . . and that if we just wait a little while, "everything will return to normal".

Indeed, Summers has admitted that too big to fail banks are a huge roadblock to economic recovery, yet he has blocked all attempts to break them up or meaningfully rein them in.

Summers said in 2000 "a healthy financial system cannot be built on the Expectation of bailouts", and then has built much of his recovery strategy on the expectation of bailouts.

A lot of his strategy has also been built on artificially propping up asset prices for things like toxic derivatives, and that strategy has failed miserably.

And it's not just that Summers has blown it. He has actively promoted a "more ruthless economy" and the "breaking down in social norms by people in a position to take" which he is now whining about.

As I wrote in March 2009:

As I noted last year:Does a single independent economist buy the Geithner-Summers-Bernanke approach?

On the left, you have:

- Nobel economist Joseph Stiglitz saying that they have failed to address the structural and regulatory flaws at the heart of the financial crisis that stand in the way of economic recovery, and that they have confused saving the banks with saving the bankers

- Nobel economist Paul Krugman saying their plan to prop up asset prices "isn't going to fly". He also said:

At every stage, Geithner et al have made it clear that they still have faith in the people who created the financial crisis — that they believe that all we have is a liquidity crisis that can be undone with a bit of financial engineering, that “governments do a bad job of running banks” (as opposed, presumably, to the wonderful job the private bankers have done), that financial bailouts and guarantees should come with no strings attached. This was bad analysis, bad policy, and terrible politics. This administration, elected on the promise of change, has already managed, in an astonishingly short time, to create the impression that it’s owned by the wheeler-dealers.

- Prominent economists like Nouriel Roubini, James Galbraith, Robert Kuttner, Dean Baker, Michael Hudson and many others slamming their approach (and Paulson's as well)

On the right, you have:

- Leading monetary economist Anna Schwartz saying that they are fighting the last war and doing it all wrong

- Former Assistant Secretary of the Treasury and former editor of the Wall Street Journal Paul Craig Roberts lambasting their approach

- Economist John Williams saying "the federal government is bankrupt ... If the federal government were a corporation … the president and senior treasury officers would be in federal penitentiary."

Of course, other Nobel economists, high-level fed officials, former White House economist, and numerous others have slammed their approach as well.

- Prominent economist Marc Faber and many others tearing their approach to shreds.

Sure, the economists for the banks and other financial giants which are receiving billions at the government trough think that the Geithner-Summers-Bernanke approach is swell.

And perhaps a couple of economists for investment funds which use their giant interventions into the free market to make some quick money.

But other than them, no one seems to be buying it.

Economist Dean Baker said the true purpose of the bank rescue plan is "a massive redistribution of wealth to the bank shareholders and their top executives".And Nobel economist Joe Stiglitz says the Geithner plan will rob US taxpayers.

And congressman Grayson puts it succinctly when he demands "Stop stealing our money!"

And as I pointed out this summer:

The bailout money didn't actually go to any productive economic uses:

The super-wealthy have been bailed out, and life is great for them. For everyone else, things are not so good.The bailout money is just going to line the pockets of the wealthy, instead of helping to stabilize the economy or even the companies receiving the bailouts:

- Bailout money is being used to subsidize companies run by horrible business men, allowing the bankers to receive fat bonuses, to redecorate their offices, and to buy gold toilets and prostitutes

- A lot of the bailout money is going to the failing companies' shareholders

- Indeed, a leading progressive economist says that the true purpose of the bank rescue plans is "a massive redistribution of wealth to the bank shareholders and their top executives"

And as the New York Times notes, "Tens of billions of [bailout] dollars have merely passed through A.I.G. to its derivatives trading partners".

- The Treasury Department encouraged banks to use the bailout money to buy their competitors, and pushed through an amendment to the tax laws which rewards mergers in the banking industry (this has caused a lot of companies to bite off more than they can chew, destabilizing the acquiring companies)

***

In other words, through a little game-playing by the Fed, taxpayer money is going straight into the pockets of investors in AIG's credit default swaps and is not even really stabilizing AIG.

The system is rigged to benefit the elites and their sycophants at the expense of the country. See this, this, this, and this.

I received the following email from a source on the Hill who has a lot of knowledge about foreclosures.

Attached is a court order quashing a case because of a counterfeit court summons. Apparently what’s happening is that private process servicer companies may not be serving people with summons, and are simply counterfeiting the documents so they can keep the fees without doing the work. That means that you could theoretically be foreclosed on without ever knowing there was even a foreclosure case against you.

This judge got wise to it.

Below are two more stories about the problem. The first is from the Florida Bar News, and the second is from prominent financial blogger Mike Konczal on the rampant violations of property rights.

Florida Bar News: Faulty filings hamper clearing foreclosures

Key quote: “If we had everyone defending their foreclosure, we’d never get through this.”

Florida’s Foreclosures Nightmare

Given that the IMF and others believe a large part of the “structural unemployment” in our country is related to the struggling housing market and underwater and barely-hanging on homeowners, what is to be done? One option is to allow for options like lien-stripping in bankruptcy courts, reseting mortgages by zip code, etc. Another option is for courts to accelerate foreclosures by ignoring due process, proper documentation and legal process in order to kick people out of their homes and preserve the value of senior tranches of RMBS while giving mortgage servicers a nice kickback.

What option do you think our country is taking?

We should all be very concerned about the foreclosure situation in Florida. If you are a homeowner or potential homeowner, you should find it offensive that people’s property rights are being violated in such a flagrant way. If you are an investor, either as “bond vigilante” or someone with a generic 401(k), you should be worried that servicers have gone rogue and the incentive structure to maximize value instead of fees associated with foreclosures has broken down.

And if you care about basic Western liberalism–the classical kind, with a Lockean understanding of freedom to own property along with freedoms of speech and religion– you should be pissed off. This is a clear-cut instance of the rich and powerful decimating other people’s property rights, rights that are supposed to protect the weak from the strong, in order to preserve their wealth and autonomy. Unless you think property rights are mere placeholders for whatever the financial sector demands are, this should be resisted. This should be viewed as a problem an order of magnitude larger than Kelo v. City of New London.

The short problem is that banks are foreclosing without showing clear ownership of the property. In addition, “foreclosure mills” are processing 100,000s of foreclosures a month without doing any of the actual due diligence or legal legwork required for the state to justify the taking of property and putting people on the street. Even worse, many are faking documentation and committing other fraud in the process. The government is allowing this to happen both by not having courts block it from going forward, but also through purchasing the services of these mills. As Barney Frank noted: “Why is Fannie Mae using lawyers that are accused of regularly engaging in fraud to kick people out of their homes?”

And the worst part is the lack of conversation about this. Thanks to Yves Smith at naked capitalism for following this story from the get-go; her blog has become the place for anyone interested in this topic (that link is a catch-up post). The rest of the media is starting to catch up to where she was weeks ago. Here’s the Washington Post with the story of an individual caught in one of these nets.

Also Dean Baker just wrote a good summary of the situation for the Guardian:

As a number of news reports have shown in recent weeks, banks have been carrying through foreclosures at a breakneck pace and freely ignoring the legal niceties required under the law, such as demonstrating clear ownership to the property being foreclosed.And the situation in Florida is worse than most assume. The specially-created courts see it as their purpose to clear out the foreclosures, as Yves Smith covers here (must read). The most obvious takeaway is that homeowners aren’t being given the chance to have their documents properly viewed, have the challenges and proper legal hurdles to putting someone on the street vetted by the courts, and instead are being bribed with an additional month of house time if they don’t ask too many questions.

The problem is that when mortgages got sliced and diced into various mortgage-backed securities, it became difficult to follow who actually held the title to the home. Often the bank that was servicing the mortgage did not actually have the title and may not even know where the title is. As a result, if a homeowner stopped paying their mortgage, the servicer may not be able to prove they actually have a claim to the property.

If the servicer followed the law on carrying through foreclosures then it would have to go through a costly and time-consuming process of getting its paperwork in order and ensuring that it actually did have possession of the title before going to a judge and getting a judgment that would allow them to take possession of the property. Instead, banks got in the habit of skirting the proper procedures and filling in forms inaccurately and improperly in order to take possession of properties.